Introduction

The story of Mt. Gox stands as a defining event in the history of cryptocurrency, a stark reminder of the industry’s early vulnerabilities. For over a decade, the 2014 collapse of what was once the world’s largest Bitcoin exchange left thousands of creditors in financial limbo. Now, in a remarkable turn of events, the final chapter is being written. This article details the ongoing repayment process, which began in July 2024 and is set to conclude by the new final deadline of October 31, 2025, finally offering closure to those affected .

The Rise and Fall of Mt. Gox

To understand the significance of these repayments, one must look back at the spectacular rise and fall of Mt. Gox.

- Humble Beginnings: Launched in 2010, Mt. Gox, an acronym for “Magic: The Gathering Online Exchange,” was originally a platform for trading cards for the popular game. It was quickly repurposed into one of the very first Bitcoin exchanges .

- Market Dominance: At its peak, the Tokyo-based exchange handled an astonishing 70% of all global Bitcoin transactions, becoming the central hub for the burgeoning crypto market .

- The Collapse: In early 2014, Mt. Gox abruptly suspended services and filed for bankruptcy protection. It was revealed that the exchange had been the victim of a massive, multi-year security breach, leading to the loss of approximately 850,000 BTC (worth hundreds of millions of dollars at the time) . While 200,000 BTC were later found, the event triggered a protracted legal battle that has lasted ever since .

The Long Road to Repayment: Key Dates and Milestones

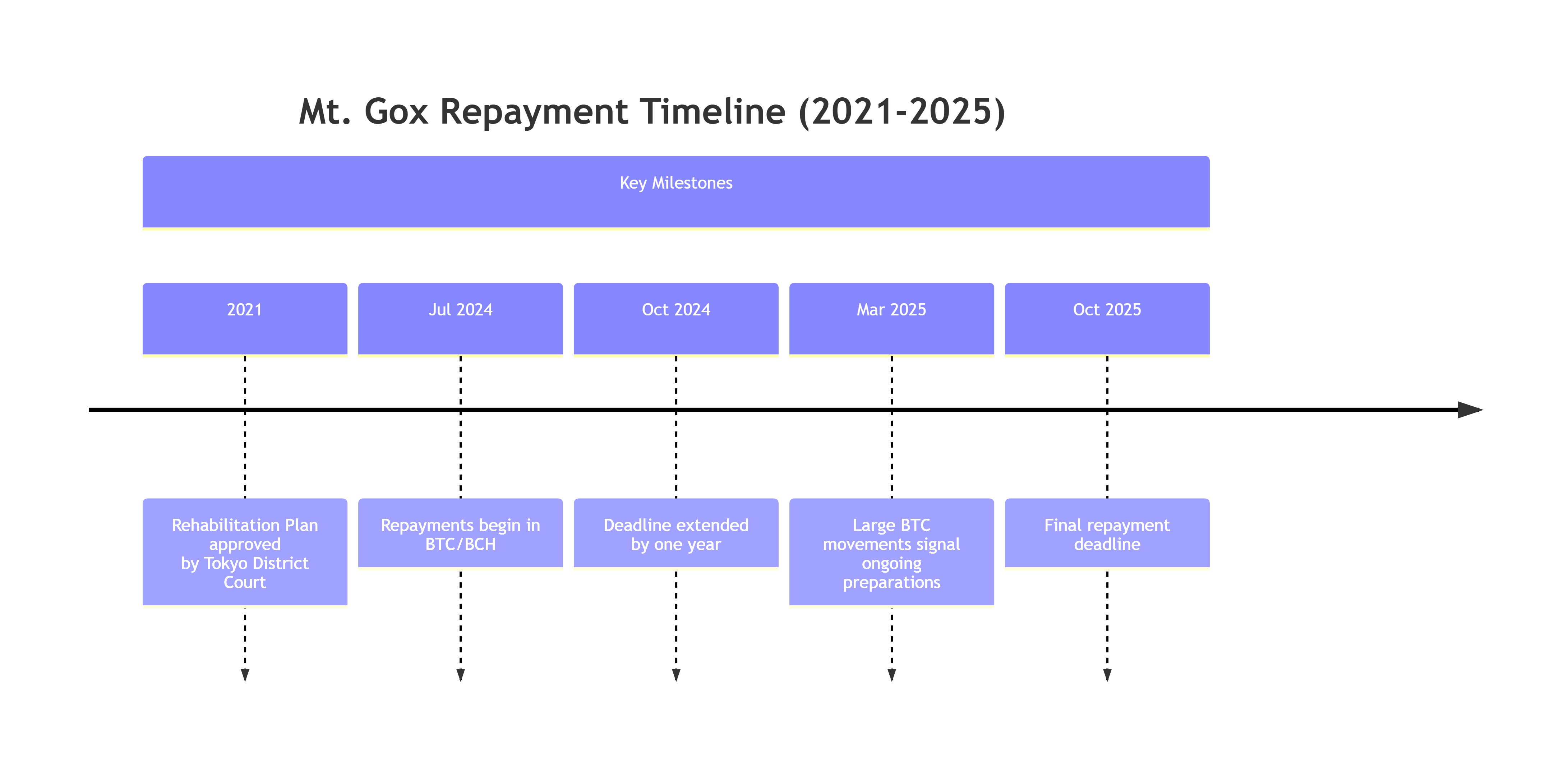

The journey to repay creditors has been complex, involving years of legal proceedings and rehabilitation plans. The following timeline highlights the critical recent milestones.

- The Rehabilitation Plan: After years of bankruptcy proceedings, a pivotal moment came in November 2021 when the Tokyo District Court officially approved a Civil Rehabilitation Plan. This plan was crucial as it allowed for creditors to be repaid in cryptocurrency (Bitcoin and Bitcoin Cash) rather than just fiat currency, a novel approach in Japanese bankruptcy law that acknowledged the original nature of the lost assets .

- Repayments Commence (July 2024): After multiple delays, the rehabilitation trustee, Nobuaki Kobayashi, announced that repayments would begin at the start of July 2024 . True to this, the process began with billions of dollars in Bitcoin and Bitcoin Cash being distributed to creditors through designated exchanges like Kraken and Bitstamp .

- Deadline Extended to October 2025: In October 2024, the trustee announced a one-year extension to the repayment deadline, moving it from October 31, 2024, to October 31, 2025. The official reason cited was that a “considerable number” of creditors had not yet completed the necessary procedures to receive their payments . This delay, while frustrating for some, temporarily alleviated market fears of a massive sell-off .

The Repayment Process and Assets

The scale of the repayment is monumental, involving a careful and structured distribution of assets.

- The Asset Pool: The funds being returned to creditors come from the assets recovered after the collapse. The estate holds approximately 142,000 BTC, 143,000 Bitcoin Cash (BCH), and 69 billion Japanese Yen (JPY) for distribution . At current valuations, the Bitcoin alone is worth billions of dollars.

- Distribution Method: Repayments are being made in a combination of cryptocurrency and fiat currency, based on the choices creditors made during the claims process . The trustee has partnered with major crypto exchanges to facilitate the crypto repayments securely . As of late 2024, data from firms like Glassnode indicated that around 59,000 BTC had already been distributed to creditors .

- Ongoing Activity: The process remains active. As recently as March 2025, wallets linked to Mt. Gox transferred over 11,000 BTC (worth around $905 million), signaling continued preparatory work for future distributions before the final deadline .

Market Impact and Creditor Response

The return of such a significant amount of Bitcoin to the market after a decade has been a major point of discussion.

- Selling Pressure Concerns: Initially, there were widespread concerns that creditors, many of whom had seen the value of their Bitcoin increase by nearly 9,000% since 2014, would immediately sell their holdings, creating significant downward pressure on Bitcoin’s price .

- A Resilient Market: So far, the market has absorbed the distributions better than many expected. On-chain data suggests that the sell-pressure from creditors has been lighter than anticipated . This is likely because many creditors are long-term Bitcoin believers who opted to be repaid in crypto and may have a HODLing mindset, choosing to retain their assets rather than sell immediately . The extension of the deadline to 2025 has also helped spread out the potential impact over a longer period .

Conclusion

The Mt. Gox repayment saga is a testament to both the failures of the cryptocurrency industry’s early days and its gradual maturation. While the process has been painfully slow for the creditors, the fact that repayments are finally underway marks a historic moment of accountability and resolution.

With the final deadline set for October 31, 2025, the world will be watching to see if this long and challenging chapter in Bitcoin’s history can finally be closed, providing a measure of justice for those who have waited over ten years to be made whole.